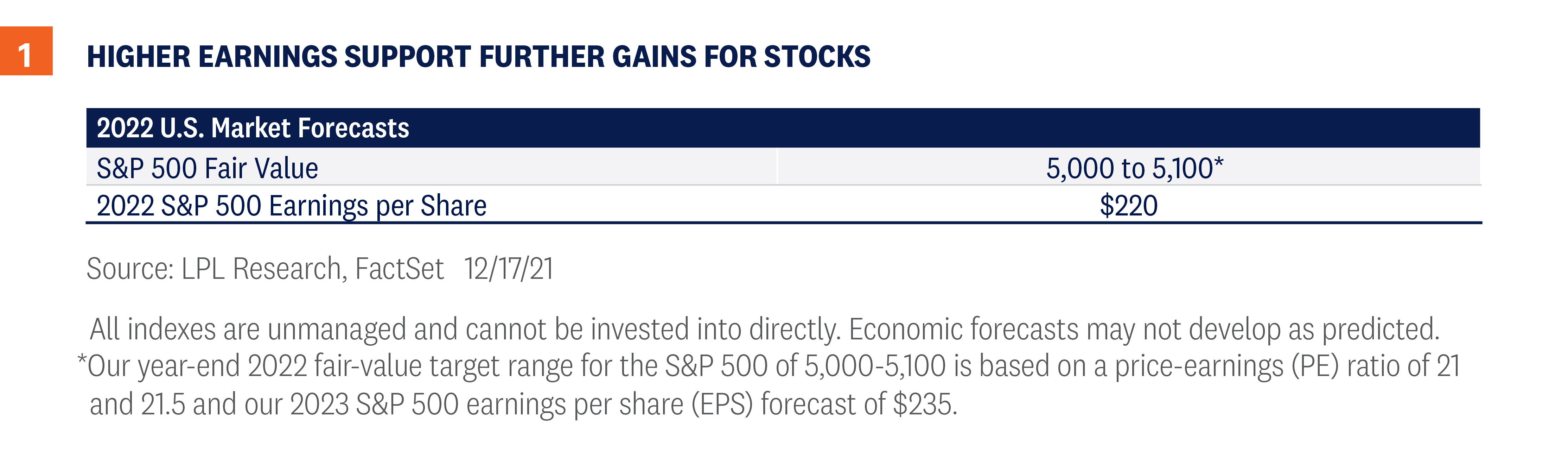

We expect solid economic and earnings growth in 2022 to help U.S. stocks deliver additional gains next year. If we are approaching—or are already in—the middle of an economic cycle with at least a few more years left (our view), then we believe the chances of another good year for stocks in 2022 are quite high. We believe the S&P 500 could be fairly valued at 5,000–5,100 at the end of 2022, based on an EPS estimate of $235 for 2023 and an index P/E between 21 and 21.5.

Most of this content was taken from Outlook 2022: Passing the Baton

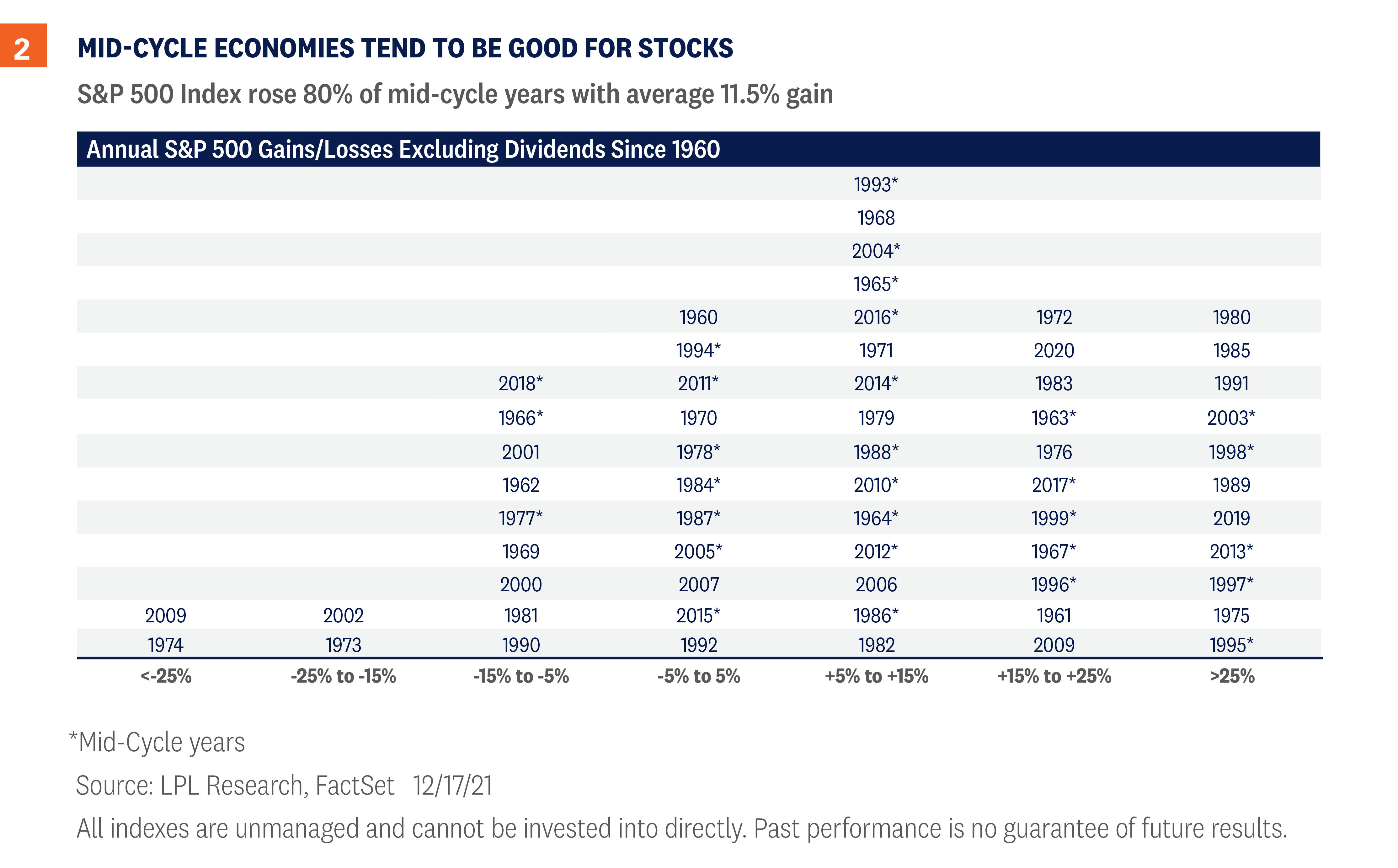

We expect solid economic and earnings growth to help stocks deliver gains in 2022. When forecasting stock market performance, we start with the economic cycle. We believe we are currently approaching—or are already in—the middle of an economic cycle with at least a few more years left. Historically, if this holds true, then we believe the chances of another good year for stocks in 2022 are quite high, which is an important added factor for our positive outlook for stocks next year [Figure 1].

The Mid-Cycle Push

Looking more closely, in a mid-cycle economy, recession fears do not typically cause stocks to fall in a given year, nor do stocks typically surge as investors celebrate emerging from the prior recession. Over the past 60 years, the S&P 500 Index was up an average of 11.5% during the 30 mid-cycle years we identified, with gains in 80% of those years [Figure 2]. As you can see, stocks rose during most of these mid-cycle years, with 1966 and 1977 being the only two years with double-digit losses.

The Fed, which we expect to start raising interest rates in early 2023, can also help us gauge the cycle because the central bank typically begins to raise rates when the economy is exhibiting mid-cycle characteristics. That also characterizes 2022 as a likely mid-cycle year. Historically, stocks have done very well during the 12 months leading up to the Fed’s initial rate hike, with gains in each of the past nine instances and an average gain of 15%. Although the timetable for the initial Fed rate hike has been moved forward several months, we expect stocks to follow this mid-cycle pattern and potentially deliver double-digit gains next year as the economy continues to expand at a solid pace.

Earnings are the Anchor

An expanding economy is a great start, but stocks fundamentally derive their value from earnings. On the top line, the environment for companies to grow revenue next year should be excellent, with potential for above-average economic growth and some pricing power from elevated inflation. Revenue growth has historically been well correlated to nominal GDP growth, which is simply real GDP growth (the inflation-adjusted number that’s normally reported) plus inflation. Our 4–4.5% real GDP growth forecast for next year plus perhaps 3% inflation (about the consensus forecast for the increase in the Consumer Price Index) puts a 7% revenue increase in play.

With stable profit margins and increasing share buybacks likely next year, a double-digit percentage increase in S&P 500 earnings per share (EPS) is a possibility. But COVID-19-related supply chain issues and materials and labor shortages are risks that could lead to higher costs in 2022, potentially weighing on profit margins. Many companies warned of such pressures during third-quarter earnings season. As a result, we are forecasting slightly below-average S&P 500 earnings growth in the 6-7% range in 2022 to $220 per share.

At this point it is unlikely that higher corporate taxes will eat into any of those earnings gains next year, as they have reportedly been pushed out into 2023 in negotiations for President Biden’s social spending package.

Valuations May Not Provide an Assist

Forecasting a year ahead is tough enough, but predicting where stocks might be at the end of 2022 actually requires us to look ahead to 2023. The 2023 earnings outlook will determine where valuations are likely to be at the end of 2022.

Strong earnings gains in 2021 have prevented the price-to-earnings ratio (P/E) for the S&P 500 from going much above 20. In fact, stocks are actually more reasonably priced as 2022 approaches than they were at the start of 2021, because 2021 earnings are tracking more than 20% above the estimate when the year began. While a 21 P/E is above the long-term average of around 16, we believe still low interest rates justify current valuation levels. But P/E multiple expansion will likely be difficult if interest rates rise in 2022, potentially leaving earnings growth as the primary driver of any stock market gains.

S&P 500 Index Knocking on the Door of 5,000?

5,000 on the S&P 500 will be a nice round number for investors to celebrate. But will that celebration take place in 2022 or later? If we assume S&P 500 EPS growth in 2023 stays around its long-term average, implying roughly $235 in EPS, while the P/E stays about where it is between 21 and 21.5, the S&P 500 could be fairly valued at 5,000–5,100 at the end of 2022. Note, however, that stocks can stay above (or below) fair value for an extended period of time due to market sentiment, so we would not necessarily view reaching that target as a sell trigger. If interest rates stay lower for longer and support P/E multiple expansion, stocks could potentially exceed this target by year-end 2022. But if profit margins face more intense pressure than anticipated, possibly from wages, earnings may have a hard time growing at all in 2022.

The Race Continues in 2022

Prospects for above-average economic growth and accompanying earnings gains in 2022 point to another potentially good year for stock investors. While the pandemic is not completely behind us as the COVID-19 Omicron variant spreads rapidly (though with a high proportion of mild cases), and there are several other risks to watch, particularly inflation, stocks have historically done well in mid-cycle economies. We do not expect 2022 to be an exception.

______________________________________________________________________________________________

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-984450-1221| For Public Use | Tracking # 1-05223960 (Exp. 12/22)

Ask a Question

Ask a Question