As the new year officially gets underway, there’s the usual sense of renewed optimism and excitement over new opportunities. However, recent stock market activity is casting a shadow over this sentiment. Momentum in equity markets has recently stalled, and breadth measures have deteriorated, suggesting the recent pullback might not be over. The silver lining to a deeper drawdown is that it could provide a buying opportunity back into this bull market, as most importantly, the S&P 500 remains above its longer-term uptrend, and fundamentals are on solid footing. The economy is holding up well; corporate earnings continue to grow at a strong pace; the Federal Reserve (Fed) is likely to cut rates further this year; and the incoming administration could deliver a pro-growth agenda with less regulation and lower taxes. And while higher rates and the potential for re-accelerating inflation remain key risks in the year ahead, we still believe this bull market deserves the benefit of the doubt.

The More Things Change, the More They Stay the Same

The S&P 500 wrapped up its first full week of trading with a loss of 1.9%. It has been a bumpy start to the New Year for stocks, but the broader market is still only around four percentage points away from record-high territory. Although the calendar has only just turned to 2025, the same concerns of last year over how inflation and the labor market could impact monetary policy were apparent in last week’s price action. Survey data among purchasing managers in the services industry revealed input costs jumped to their highest level since early 2023 last month. LPL’s Chief Economist Jeffrey Roach noted the report was “a bad omen for the inflationary environment.” The market seemed to agree as stocks declined and yields rose following the data release.

There was also no shortage of labor market data to assess last week. Friday’s employment report carried the most weight and showed the U.S. economy added 256,000 jobs last month, marking a nine-month high and widely exceeding consensus estimates. This brings the 2024 average monthly gain in private payrolls to 149,000 — cooler than the 2023 average of 192,000.

On a short-term basis, the market has shifted back to a good-news-is-bad-news backdrop. However, it is important to remember that, in the long term, good economic news is usually good for equity markets as it implies better-than-expected growth, upside potential to earnings, and reduced recession risk.

Technical Setup

Despite an unseasonably weak finish to an otherwise stellar 2024, the S&P 500 remains above its longer-term uptrend. There also has been no major risk-off rotation within the index as cyclical/offensive sectors continue to lead on a relative basis. However, the recent break below support at 5,860 completed a shorter-term top formation that points to a deeper pullback toward the July highs at 5,667 or even the 200-day moving average (dma) at 5,573.

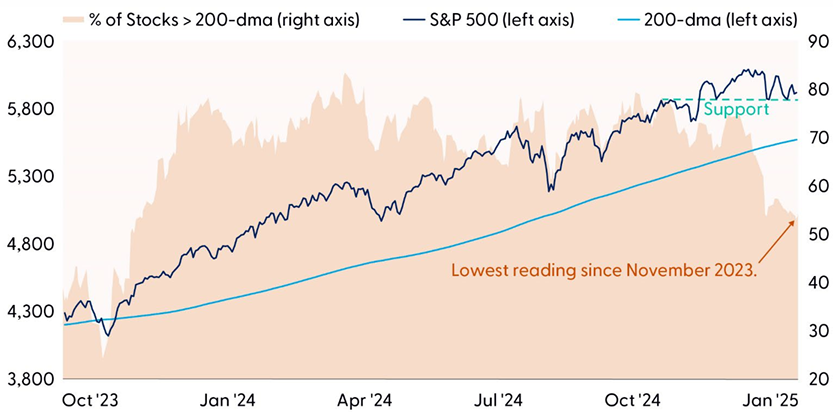

Technical damage within the index has been a little more noticeable. As highlighted in the shaded section of the “Technical Damage Has Been Most Noticeable Underneath the Surface” chart, market breadth — as measured by the percentage of index constituents trading above their 200-dma — has not kept up with the S&P 500. This divergence between price and breadth implies fewer and fewer stocks participated in the post-Election Day breakout to new highs. And while these deviations can persist for extended periods, they often foreshadow building vulnerabilities of a rally susceptible to stalling.

Currently, only around 56% of S&P 500 stocks remain above their 200-dma. This is down from over 75% in November and the lowest reading in over a year. Historically, once this indicator falls below 48%, forward 12-month S&P 500 returns have averaged -7.3%.

Technical Damage Has Been Most Noticeable Underneath the Surface

Source: LPL Research, Bloomberg 01/09/25

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Rates on the Rise

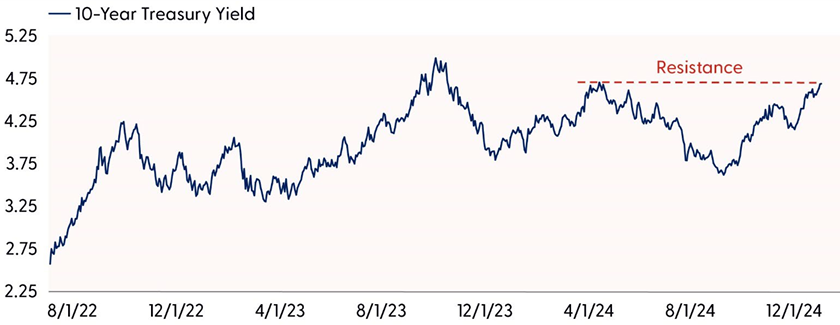

The paradox of rising Treasury yields and monetary policy easing has continued into the new year. Since the Fed’s “hawkish” rate cut on December 18, the 10-year Treasury yield has risen nearly 0.4%, bringing its total increase to over 1.0% since the rate-cutting cycle began last September. This rise is almost the opposite of the amount by which the Fed has cut rates.

For the stock market, rates may have broken above the pressure point for risk appetite. Equity investors tolerated rising rates throughout most of last fall as the absolute level of yields was a bit more digestible and accompanied by better-than-expected economic activity. The “Yields Are Retesting an Important Resistance Level” chart highlights how 10-year Treasury yields and the Citi U.S. Economic Surprise Index rose in lockstep until mid November. (For context, the surprise index tracks how economic data compares to market expectations, with positive values indicating better-than-estimated results and vice versa for negative readings.) However, this relationship has since changed as yields continue to advance as the surprise index turns lower. The recent deviation can largely be explained by the rise in the Treasury term premium — the expected excess yield investors require for holding longer-duration Treasuries. As LPL’s Chief Fixed Income Strategist Lawrence Gillum recently noted (and explains in the January 8, 2025 Street View video), the rising term premium is mainly attributable to concerns over inflation and the massive amount of Treasury supply needed to finance our ballooning U.S. deficit.

Technical trends point to upside risk for yields. The 10-year has recently reversed a downtrend and surpassed several key areas of overhead resistance. Regarding potential upside, a close above the April highs at 4.74% would likely open the door for a retest of the October 2023 highs near 5%.

Yields Are Retesting an Important Resistance Level

Source: LPL Research, Bloomberg 01/09/25

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Seasonal Setup

Seasonal signals have turned mixed this month. The S&P 500 wrapped up the closely watched Santa Claus Rally period with a loss. Historically, a negative return during this seven-day stretch (the last five trading days of the year plus the first two trading days of the New Year) has produced annual average S&P 500 price returns of only 6.1%, compared to the average gain of 10.4% for positive signals.

On a more positive note, the market did produce a positive return for the First Five Days of January indicator, another seasonal indicator developed by Yale Hirsch, creator of the Stock Trader’s Almanac. When the indicator is positive and stocks are higher during the first five days of the year, the S&P 500 has historically generated an average annual price return of 14.2% since 1950, with 83% of years also producing positive returns. In contrast, when the S&P 500 trades lower during the first five days of the year, average annual returns fall to only 1.1%, with only 56% of occurrences producing positive results.

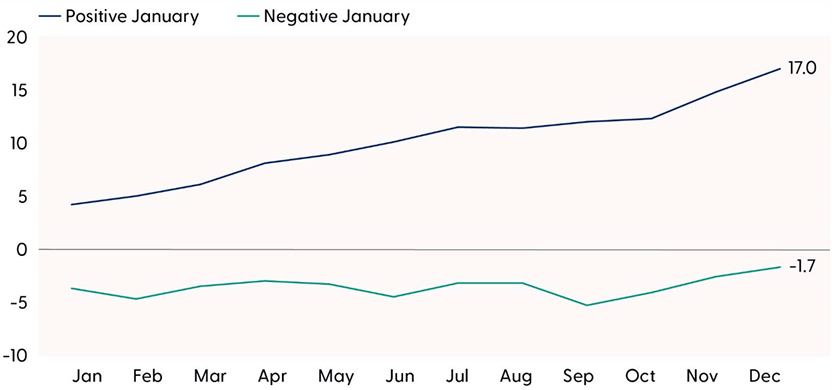

Given the mixed signals, the January Barometer is now left to settle the seasonal score. A positive month would be a welcome sign for stocks, as according to Yale Hirsch, “As goes January, so goes the year.” As highlighted in the “S&P 500 Annual Performance Based on January Returns” chart, this popular Wall Street maximum has stood the test of time. Since 1950, the S&P 500 has posted an average annual price gain of 17% during years that included a positive January, with gains impressively 89% of the time. In contrast, when the index traded lower in January, annual returns dropped to -1.7%, with only 50% of occurrences producing positive results.

S&P 500 Annual Performance Based on January Returns (1950–2024)

Source: LPL Research, Bloomberg 01/09/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Conclusion

Stocks are struggling to gain traction in the new year. Recent signs of inflation pressure and reduced expectations for Fed rate cuts have pushed rates to uncomfortably high levels, complicating the macro backdrop. Unfortunately for stocks, near-term technical trends point to additional upside risk for Treasury yields. Based on this backdrop and the current technical setup for the broader market, we believe a deeper pullback remains potentially on the table as market breadth and momentum wane. However, despite the near-term risks, we believe investors should give the bull market the benefit of the doubt as the longer-term uptrend is intact, leadership remains cyclical, and fundamentals are on solid footing.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, with a preference for the U.S. over international and emerging markets, a slight tilt toward growth, and benchmark like exposure across the market capitalization spectrum. The Committee recommends benchmark-level fixed income exposure, with an emphasis on intermediate maturities, and an allocation to preferred securities. The STAAC also recommends an underweight to cash and, for appropriate investors, an allocation to diversifying liquid alternatives, specifically global macro and multi-strategy funds.

As discussed in our Outlook 2025: Pragmatic Optimism, we expect stocks to move modestly higher in 2025 while acknowledging reasonable upside and downside scenarios. Upside support could come from economic growth, a supportive Fed, strong corporate profits, and supportive policies from the Trump administration. The most likely downside scenarios involve re-accelerating inflation, higher interest rates, and geopolitical threats that do economic harm. We cannot rule out the possibility of short-term weakness as sentiment remains stretched and a lot of good news is priced into markets. If inflation re-accelerates, equities may need to readjust to what could be a slower and shallower Fed rate-cutting cycle than markets are currently pricing in.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0002683-1224Tracking #681221 | # 681329 (Exp. 01/26)

Ask a Question

Ask a Question