Stocks continued to climb the wall of worry last week and shrugged off tariff headlines, inflation volatility, and signs of a slowdown in retail spending. President Trump reinstated a full 25% tariff on all steel imports — effectively closing any loopholes and exemptions — and increased the tariffs on aluminum imports to 25%. Most metals rallied on the news as fear over forthcoming tariffs on a broader range of metals sparked a surge in demand. The White House also announced plans to impose reciprocal tariffs on a country-by-country basis to “correct longstanding imbalances in international trade and ensure fairness across the board.” Stocks discounted the news after it was revealed the tariffs would not be implemented until April, leaving some time for negotiations. A drop in the dollar and interest rates provided another tailwind for risk appetite last week.

Tariffs and Inflation

Tariff policies and their impact on inflation were a popular topic during Federal Reserve (Fed) Chair Jerome Powell’s Semiannual Monetary Policy Report to Congress last week. While Powell carefully dodged the tariff and Trump policy questions, he did reiterate that policymakers were in no hurry to cut rates as there is “still more work to do” on inflation. Economic data agrees — and we are not just talking about a 15% jump in egg prices last month. The January core consumer inflation report came in hotter than expected last week, with the Fed’s closely watched “supercore” inflation gauge rising by the fastest rate in 12 months (this metric takes out energy, food, and housing). It wasn’t all bad news on the inflation front, as several wholesale inflation components that feed into the Personal Consumption Expenditure (PCE) data were lower last month, reducing upside risk to next Friday’s PCE report. Furthermore, Friday’s disappointing January retail sales data indicates consumers may be pulling back spending after a strong holiday season.

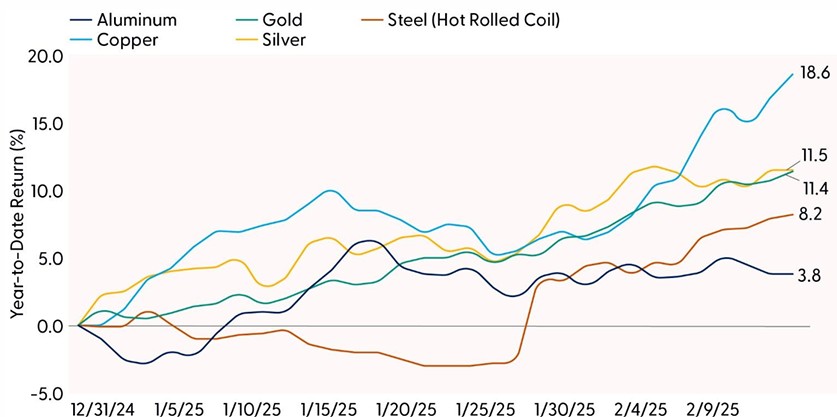

While the newly announced 25% tariffs on aluminum and steel imports may have minimal impact on inflation or domestic growth (the metals only accounted for around 1.8% of total goods imported into the U.S. last year, per S&P Global), they could have detrimental knock-on effects for downstream applications such as autos, manufacturing, and the building and construction space. This also comes at a time when many industrial and precious metals are already rising. Copper prices have rallied nearly 20% this year, while silver and gold are up double digits. A lot of these gains have occurred over the last few weeks as buyers have begun to reprice tariff risks across the metal spectrum, not just on aluminum and steel. This has been notably apparent when comparing prices across global exchanges. For example, copper trading on the Chicago Mercantile Exchange (CME) hit a record-high premium to copper priced on the London Metal Exchange (LME). This premium for securing copper warehoused in the U.S. right now has pushed CME inventory levels to their highest level since 2018.

Metals Are Heating Up

Source: LPL Research, Bloomberg 02/13/25

Disclosures: Past performance is no guarantee of future results. Generic level commodity prices/indexes. Any commodities or futures referenced are being presented as a proxy, not as a recommendation.

What Does This Mean for Investors?

Higher metal prices (tariffs or no tariffs) increase costs on the downstream user and can be inflationary. These added costs can show up via reduced profit margins if the company absorbs the increased cost, or they get passed down to the end consumer via higher prices. Of course, they also represent investment opportunities in the metals complex. And one of those opportunities lies in the gold market. Gold prices surged nearly 25% last year despite higher yields and a stronger dollar; typically, these macro factors represent major headwinds for the precious metal. Momentum in gold has continued into 2025 as tariff fears spurred safe haven flows and demand for gold exchange traded funds (ETFs).

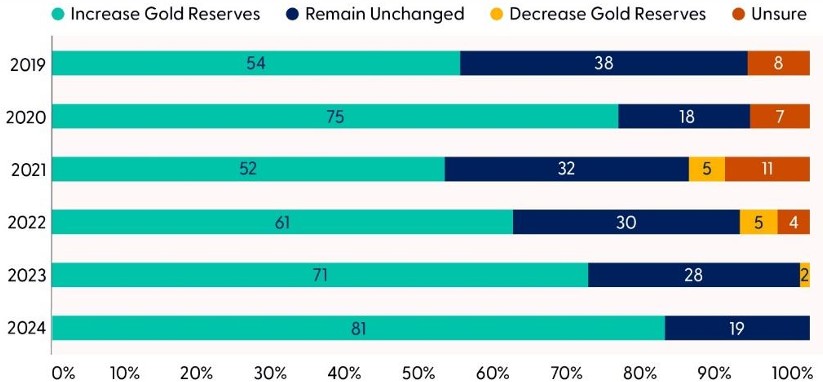

Another big catalyst for gold has been steady demand from global central banks, which continue to diversify reserve holdings away from the dollar. According to the World Gold Council, global central banks added 1,045 metric tons of gold in 2024, marking the third straight year in which demand topped 1,000 metric tons (for context, central bank annual demand averaged 473 metric tons from 2010–2021). Adding gold and reducing dollars has been a growing theme among global central banks. Over the last several years, central bankers have expressed an increased intent to add to their gold reserves. In 2024, 81% of central bankers indicated they would increase their gold reserves over the next 12 months, with only 19% indicating they would leave their gold reserves unchanged. Furthermore, 62% reported they would lower their dollar reserves over the next five years.

Central Bankers Plan to Increase Gold Reserves Over the Next 12 Months

Source: LPL Research, World Gold Council, 02/13/25

Can Gold Continue to Shine?

Gold broke out to record highs earlier this month after surpassing resistance off the October highs. On a short-term basis, prices are historically overbought, suggesting they could potentially be due for a pullback or consolidation phase. In the event of a drawdown, in our opinion, support — areas where demand tends to be strong enough to prevent prices from falling — for the yellow metal is around $2,818 (20-day moving average) and $2,790 (October high). However, longer-term momentum indicators remain positive, and gold continues to trend within a rising price channel. Last week’s breakdown in the dollar could be another tailwind for gold and the broader commodities complex.

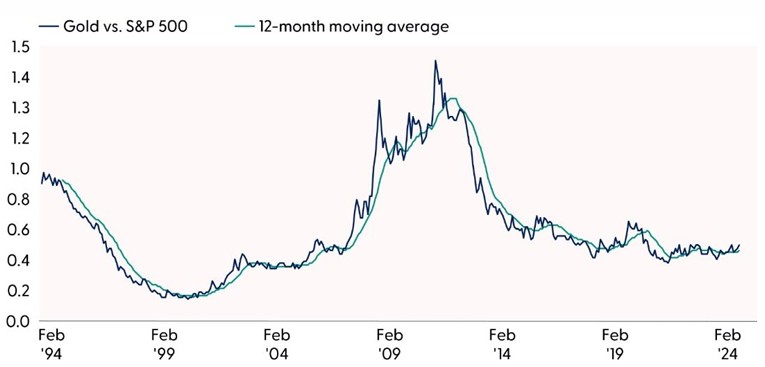

On a relative basis, when we step back and compare gold to the S&P 500 over the last 30 years, bullion still appears cheap to the broader market. This ratio chart — used to define relative trend strength and direction — has started to form a potential bottom and is back above a rising 12-month moving average. While we are not advocating investors rotate from equity markets to gold, we do reiterate our positive view on precious metals, a view we have held since last spring.

Despite the Rally, Gold is at Relatively Low Levels Compared to Stocks

Source: LPL Research, Bloomberg 02/13/25

Disclosures: Indexes are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results. Any commodities referenced are being presented as a proxy, not as a recommendation.

Conclusion

Tariffs continue to create headline risk for the broader market. However, investors have mostly discounted their impact due to delayed implementation and what appears to be a willingness from the White House to negotiate. The metals market has had more of a response as tariffs on aluminum and steel go into effect next month. At the same time, expectations are rising for additional tariffs on other industrial and precious metals. The repricing of tariff risk has pushed most metals higher, raising input costs downstream that could weigh on margins or consumer prices. Gold continues to shine within the metals complex, with macro and technical tailwinds suggesting its uptrend could continue.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, with a preference for the U.S., for growth over value, and benchmark-like exposure across the market capitalization spectrum. However, we do not rule out the possibility of short-term weakness as sentiment remains stretched and a lot of good news is priced into markets amidst lingering inflation, elevated trade tensions, and several geopolitical threats that are difficult to dismiss.

Within fixed income, the STAAC continues to recommend modest exposure to preferred securities as valuations remain attractive. However, the risk/reward for core bond sectors (U.S. Treasury, agency mortgage-backed securities, investment-grade corporates) is more attractive than plus sectors. The Committee does not believe adding duration is attractive at current levels, and the STAAC remains neutral relative to our benchmarks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0002850-0125 Tracking #697535 | #697537 (Exp. 02/26)

Ask a Question

Ask a Question