A lot has changed in the past few weeks, both in terms of expectations for interest rates and lost confidence in the health of the banking system as a result of the sharp rise in interest rates that has led to some things “breaking,” as we wrote about here last week. Here we share some thoughts on who’s to blame for the ongoing banking crisis and reiterate how we are telling investors to adjust, or not adjust, their asset allocations in light of ongoing market volatility.

Markets on Alert

It’s difficult to grasp that just a few weeks ago, the fed funds futures market had priced the terminal rate at nearly 6%. The market’s hawkish outlook was predicated on the Federal Reserve (Fed) raising rates amid a still solid economy underpinned by a tight labor market and consumer spending, but with inflation still above the 2% level that reflects price stability.

Now, with continued pressure on both domestic and global banks, markets are expecting the Fed will be forced to cut rates towards the end of this year as loan growth slows and businesses, particularly small businesses, and consumers find it more difficult to secure loans. As a result, the broader economy is expected to be negatively affected.

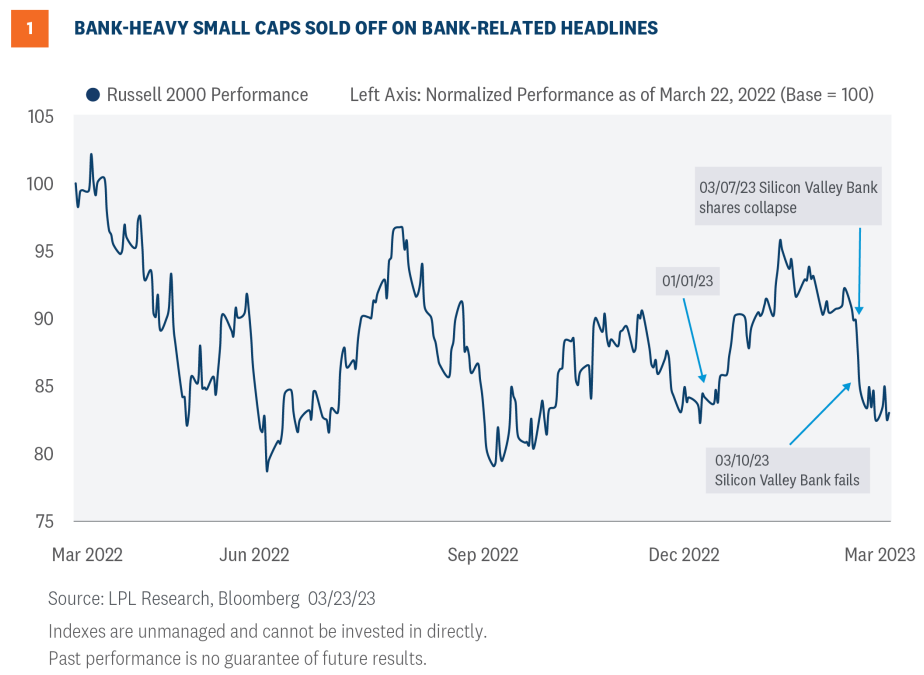

The rapid collapse of Silicon Valley Bank (SVB), followed by continued pressure on regional banks, along with headlines surrounding the struggle to shore up confidence in First Republic Bank (FRC), has the market on alert for other potentially vulnerable banks. The banking stress of the past couple of weeks has put some heavy pressure on the bank-heavy small cap Russell 2000 Index (Figure 1).

The swift crash of Signature Bank, the third largest bank failure in U.S. history, following the demise of SVB, which held $160 billion in deposits, along with Silvergate Bank, has investors and depositors questioning if the banking system is as “sound and resilient with strong capital and liquidity” as suggested recently by both Fed Chair Jerome Powell and Secretary of the Treasury Janet Yellen.

To be sure, the Fed’s emergency bank lending facility, the Bank Term Funding Program, which was quickly put in place to help strengthen the banks, also served to restore confidence as banks grapple with depositors who are seeking higher rates elsewhere, and who are also increasingly concerned about the viability of the banks themselves.

Finger Pointing:Who’s to Blame?

No sooner had news regarding the run on SVB hit the media, generalized fear and panic spread quickly. Depositors mounted a modern-day run on the bank using their smart phones, and over the course of 36 hours, the bank was forced to sell $21 billion of long duration bonds at a loss of $1.8 billion.

The blame was quickly focused on venture capitalists who sent out immediate warnings to their start-up companies to withdraw their funds at once. SVB’s large client base was broadly made up of fledgling technology companies backed by venture capital. It didn’t take long for depositors to exit.

A widely followed newsletter that covers the venture capital world, “The Diff,” has also been considered the spark that led to the mass exodus of deposits, when in late February the report indicated that SVB’s debt-to-asset ratio was 185 to 1, implying that the bank was virtually insolvent. The underlying culture of the tech world has also come under scrutiny as to how rapidly conclusions were drawn and how instantaneously they were acted upon.

Mismanagement and Regulatory Failures

The deficit of a functioning risk management team has been the most enduring criticism of SVB, while criticism has similarly been leveled at the supervisory team at the San Francisco Fed, which is supposed to monitor the operations of the banks within its regulatory jurisdiction. The lack of communication from the bank’s senior leadership didn’t help matters.

Silvergate Bank, with $12 billion in deposits, is most closely associated with crypto activities, but suffered a swift run on its holdings around the same time as the SVB failure. Despite early warnings of fragility in the wider crypto world, and with risks climbing, there was apparently, according to media reports, little contact with supervisors from the San Francisco Fed.

At the Federal Open Market Committee (FOMC) meeting press conference on March 22, Powell addressed criticism that there wasn’t any supervision of operations at SVB. He stressed that there were red flags raised months ago by examiners from the San Francisco Fed, but he couldn’t say whether the warnings were escalated. “We’re doing the review of supervision and regulation,” Powell said, and “My only interest is that we identify what went wrong here.”

Senator Elizabeth Warren, the leading Democrat on the Senate Banking Committee, blamed Powell for the banking crisis in no uncertain terms, saying that he was an integral part of the process that weakened regulatory oversight of regional banks, “Fed Chair Powell’s actions contributed to these bank failures.”

Monetary and Fiscal Policy

Moving up the blame chain leads directly to the monetary and fiscal policies that flooded the banking system with government transfers to consumers and small businesses, coupled with interest rates that stayed near zero for too long, which allowed risk to intensify across the investing spectrum.

With the Fed’s insistence that the inflationary effect was “transitory” and primarily due to COVID-19-related supply chain challenges, the central bank was slow to begin raising interest rates. With financial conditions remaining loose, risk taking was elevated in venture capital, private equity, and real estate, especially commercial real estate. But as the Fed finally launched its aggressive rate hiking campaign, the dynamic changed.

The collapse of SVB, followed by the other banks that were victims of the immediate panic that ensued, is emblematic of the changing landscape. When all is said and done, the blame falls on all of the above for failing to recognize the risks associated with policies that allowed risk taking but then quickly turned off the spigots.

Asset Allocation Views

In the current environment of elevated volatility and concerns about banks, LPL Research believes tactical investors should still maintain multi-asset allocations at or near benchmark levels with an emphasis on diversification.

Within fixed income, LPL Research continues to like the preferred sector to take advantage of attractive valuations with less risk than equities.

Within equities, the technology sector looks better to us here, which, along with the Strategic and Tactical Asset Allocation Committee’s (STAAC) recent decision to downgrade healthcare to neutral, suggests limiting the size of any style tilts toward value. The Committee continues to take a wait and see approach on the banks while closely watching the latest developments. Finally, precious metals related investments warrant consideration on the long side, in our view.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Asset allocation does not ensure a profit or protect against a loss.

A CDS contract is a derivative product that protects the CDS buyer from a credit default of the underlying security. Credit risk is transferred to the seller of the CDS contract, who requires a premium for the protection. As credit risk increases or decreases, the contract premium goes up and down, similar to an insurance policy.

A typical notional on a CDS is in the range $10-$20 mm. CDSs have a stated maturity (typical terms are 3, 5, 7, and 10 years), with the most liquid point at 5 years. Typically, credit default swaps are the domain of institutional investors.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. As interest rates rise, the price of the preferred falls (and vice versa). They may be subject to a call feature with changing interest rates or credit ratings.

The fast price swings in commodities will result in significant volatility in an investor’s holdings. Commodities include increased risks, such as political, economic, and currency instability, and may not be suitable for all investors.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-1471350-0323 | For Public Use | Tracking # 1-05365330 (Exp. 3/2024)

Ask a Question

Ask a Question